Stanford Market is a trading platform offering various financial instruments to provide a secure and innovative trading experience. This StanfordMarket.com review looks at the platform’s key features, available assets, pricing, and areas that could be improved. By examining these aspects, traders can decide if Stanford Market meets their trading requirements. While the platform uses advanced technology, this review highlights its strengths and weaknesses, giving potential users a clearer picture of what to expect when trading.

Broad Spectrum of Trading Instruments

One of Stanford Market‘s key strengths is its wide variety of tradable assets. From Contracts for Difference (CFDs) to major indices, traders can explore multiple financial markets without owning the underlying assets.

Stocks and Cryptocurrencies

Stanford Market facilitates trading in CFDs across popular stocks and cryptocurrencies, allowing traders to capitalise on price movements in these volatile markets. With the global surge in cryptocurrency trading, the platform’s flexibility in offering these assets enhances its appeal to traders seeking exposure to the digital asset market.

Forex and Commodities

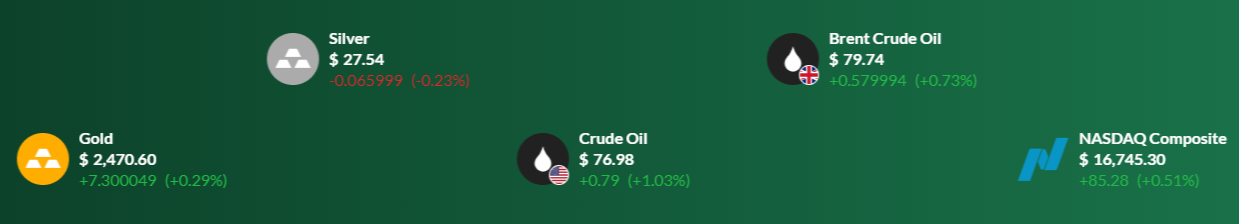

Stanford Market provides access to major and minor currency pairs, known for its high liquidity and daily trading volume exceeding $6 trillion. Additionally, commodities like gold, silver, oil, and agricultural products offer traders opportunities to hedge against inflation and diversify their portfolios. This variety caters to trading strategies, from short-term speculation to long-term investments.

Exchange-traded funds (ETFs)

Another notable feature is the platform’s inclusion of ETFs, which enable traders to invest in a basket of assets across global markets. ETFs are an excellent tool for those seeking diversification without purchasing individual stocks or commodities directly.

Competitive Pricing and Low Spreads

Transaction costs are a critical factor in determining profitability for any trader. Stanford Market offers competitive pricing with tight spreads, a key advantage for traders. A tight spread of 0.1 pips, compared to larger spreads of 1 pip or more on other platforms, significantly impacts the bottom line. The lower the spread, the fewer transaction costs traders must overcome, allowing them to focus on increasing their profit margins.

Integrity and Transparency in Trading

According to a StanfordMarket.com review, the broker’s strong focus on integrity builds trust with its traders. Transparency in fees, operations, and customer support is central to the company’s business ethics. Stanford Market ensures that clients’ trades are executed fairly, without hidden costs or unnecessary delays. This ethical approach fosters long-term relationships and encourages traders to stay loyal to the platform.

Innovative Trading Technology

Innovation drives Stanford Market’s value proposition. The platform incorporates state-of-the-art trading technology, offering traders access to advanced charting tools, algorithmic trading options, and real-time market data. These features empower both new and experienced traders to make well-informed decisions quickly.

Customisable Charting Tools

Stanford Market’s charting tools can be fully customised, allowing traders to adjust the display according to their preferences. This level of customisation includes a variety of chart types, technical indicators, and drawing tools, all of which are essential for precise market analysis and strategy development.

Automated Trading Systems

The platform supports automated trading systems, which allow traders to set predefined rules for trade execution. By automating the process, traders can minimise emotional decision-making and focus on strategy optimisation.

Support and Empowerment through Education

The broker is committed to empowering its clients by providing educational resources. The platform offers multiple learning materials, including webinars, tutorials, and market analysis, making it accessible to beginners and experienced traders. This emphasis on education helps traders understand how to manage the challenges of financial markets.

Community Engagement and Market Insights

One of its standout features is its thriving community of traders. The platform encourages interaction among traders, promoting shared insights and strategies. This sense of camaraderie can be beneficial, particularly for those new to trading or those looking to refine their techniques.

Additionally, Stanford Market offers a dedicated market news channel, providing timely updates on economic indicators, geopolitical events, and market trends. Staying informed helps traders make strategic decisions and adjust their portfolios accordingly.

Refund and Withdrawal Process at Stanford Market

In the StanfordMarket.com review, users can gain a clear understanding of the steps involved in processing refunds and withdrawals. Before a refund can be initiated, users must complete a verification procedure. This involves submitting a colour copy of a photo of ID, such as a passport, driver’s license, or national ID card. Additionally, users must provide a colour copy of the front and back of their debit or credit card. Proof of address, like a bank statement, must also be submitted for verification.

The broker offers three options for fund withdrawals: credit card, bank wire transfer, and Bitcoin transfer. Once the necessary verification has been completed, these methods allow users flexibility when accessing their funds.

Drawbacks Explored in StanfordMarket.com Review

No Multilingual Support for Traders

One significant drawback of Stanford Market is the need for multilingual support. Traders from non-English-speaking regions may face challenges navigating the platform and understanding the available resources. This limitation can hinder effective communication between the platform and a broader global audience, potentially leading to misunderstandings or delays in resolving issues.

Absence of a Demo Account

Stanford Market does not offer a demo account for its users, which can be a disadvantage, especially for beginner traders. Demo accounts allow traders to practice trading risk-free before committing real funds. Without this feature, new traders are forced to learn through live trading, which can result in unnecessary financial losses and a steeper learning curve.

Article Needs Frequent Updates

Another area where the broker could improve is the frequency of updates to its educational articles. While the platform provides various resources, more regularly updated content is needed to keep up with the evolving nature of the financial markets.

More Payment Options Required

Stanford Market offers limited payment methods, which can restrict flexibility for users who prefer alternative ways to fund their accounts.

Offering a wider range of payment options, including region-specific methods, would appeal to a larger audience and improve the overall user experience.

Conclusion

This StanfordMarket.com review highlights the trading platform’s strengths and areas for improvement. Stanford Market offers an impressive range of financial instruments, competitive pricing, and advanced trading tools, making it a compelling choice for traders at all levels. However, the platform could benefit from introducing multilingual support, a demo account, and additional payment options. Overall, Stanford Market continues to innovate and empower its users, providing an efficient platform for trading in the fast-paced financial markets.

Disclaimer – This article is provided for informational purposes only and is not intended as a recommendation. The author disclaims any responsibility for the company’s actions in the course of your trading activities. It’s important to understand that the information presented in this article may not be entirely accurate or current. Your trading and financial decisions are your own responsibility, and it is vital not to rely solely on the content provided here. We make no warranties about the accuracy of the information on this platform and disclaim any liability for losses or damages arising from your trading or investment decisions.

1 thought on “StanfordMarket.com Review Explores Its Features, Assets, and Trading Experience”